Block Of Apartments, 9 South Street, Manningtree

9 South Street, Manningtree

Churchwood Stanley

Churchwood Stanley, 2 The Lane

Description

Historic Grade II Listed Freehold Investment in Manningtree

A rare opportunity to acquire a fully-let Grade II listed period property comprising three self-contained flats in the heart of Manningtree, Essex. This handsome red-brick building offers immediate rental income, a strong gross yield of ~6.7%, and significant character appeal – ideal for investors seeking both returns and heritage value.

Property Overview

Located at 9 South Street, Manningtree (CO11 1BB), the property is an early 19th-century three-storey building with an attractive historic façade. Originally a butcher’s shop established around 1800, it still retains period features such as sash windows and a parapet front. The building is Grade II listed, denoting its special architectural and historic interest. It consists of three separate apartments – one on each floor – and the sale is for the entire freehold title, meaning the buyer acquires the whole building (all units) in one lot.

Flat 1 (Ground Floor): a cosy 1-bedroom unit (formerly the old shop space) with its own entrance. It is currently let to a long-term tenant at £475 per month (assured shorthold tenancy).

Flat 2 (First Floor): a generously sized 2-bedroom apartment, also occupied by a long-term tenant at £875 per month rent.

Flat 3 (Second Floor): a character 1-bedroom flat, presently operated as a holiday let (Airbnb) with a nightly rate ranging ~£90–125. This unit generated approximately £18,000 in rental income last year due to strong occupancy from short-term guests.

All three flats are in good rentable condition (as evidenced by the continued tenancies and guest reviews). The property also benefits from a large cellar beneath the building, offering additional storage space for tenants or the potential for other uses (subject to any necessary permissions).

Income & Yield

This investment comes fully income-producing from day one. Total gross rental income is roughly £34,200 per annum (combining the two long-term rents and the annualized short-let income). At the £500,000 asking price, this equates to an attractive gross yield of about 6.7%. In the current market, rental yields between 5% and 8% are considered good, with 6–8% deemed “very good” for buy-to-let investments. The ~6.84% yield on this property therefore represents a very solid return, especially for the sought-after South East region.

Importantly, there is a mix of secure long-term rent (from Flats 1 and 2, providing steady base income) and high-return short-let rent (from Flat 3, capitalizing on the area’s tourism demand). An investor could continue the profitable Airbnb strategy – last year’s £18k from Flat 3 significantly boosts the overall yield – or opt to let it on a standard tenancy for potentially more hands-off consistency. There may also be scope to increase revenues (e.g. optimizing the short-let occupancy, or modest rent uplifts on renewal, subject to market conditions).

All apartments are separately metered and have their own facilities, simplifying management. As the freehold owner, you have control over the entire building with no ground rents or service charges payable to an outside freeholder – enhancing your net rental returns.

Location & Heritage Appeal

Manningtree is a highly desirable location – known as “England’s smallest town” by area – offering quaint charm and strong rental demand. The town sits on the banks of the River Stour at the edge of the Dedham Vale Area of Outstanding Natural Beauty (AONB), an area famed as “Constable Country” for its picturesque landscapes. Tourism is a key part of the local economy, and Manningtree is “a town of immense charm and character” with Georgian facades and historic buildings dating back to Tudor times. This heritage ambiance attracts many visitors and tenants who appreciate the character of the town.

The property’s position on South Street is truly in the heart of Manningtree – a short stroll to the High Street shops (a Tesco Express is ~30m away), cafes, pubs and the charming market square. Manningtree’s convenience is a big draw: the town of Colchester, the coastal port of Harwich, and Ipswich are all within about a 20-minute drive, expanding the pool of potential tenants and visitors. For London commuters or tourists, Manningtree railway station (approximately 1.3 km from the property) offers regular direct trains to London Liverpool Street (journey ~60 minutes), as well as services to Norwich and Harwich. This connectivity makes Manningtree popular for those seeking a more peaceful home base while working in or visiting London.

Investors will appreciate that the property’s historic Grade II status not only signifies robust construction and character, but also that such period properties in central Manningtree are scarce and hold their value well due to limited supply. The listing designation was granted as far back as 1973, reflecting features like the early-1800s shopfront with original butcher’s hooks and signage – a conversation piece that underscores the building’s story. Owning this property is not just an investment in bricks and mortar, but in a slice of local history.

Investment Highlights

Fully Let Freehold Block: Purchase includes all three flats on one freehold title – a turnkey investment with no leasehold complications. Two units have established tenants and the third generates high short-let income, ensuring immediate cashflow.

Strong Rental Yield: Gross annual income of ~£34.2k yields approximately 6.84% at asking price, which is considered a very good return in the current markets. This yield could potentially grow with further holiday-let optimization.

Historic Grade II Listed Building: Early 19th-century construction with a preserved Georgian frontage and historical significance (original shop “Established 1800” still remembered on the façade. Appeals to heritage-conscious tenants and adds long-term value stability.

Prime Town Centre Location: Situated on a picturesque street in Manningtree’s town centre, England’s famed “smallest town”. The location offers superb convenience for tenants (shops, eateries and services on the doorstep) and charm for short-let guests. Manningtree’s attractive setting on the River Stour and abundant local character draw consistent demand.

Good Transport Links: Easy road access to nearby towns (Colchester, Ipswich, etc.) and a direct rail link to London in about an houren.wikipedia.org make this location practical for commuters and popular with visitors, underpinning rental demand.

Diversified Income Streams: A blend of stable long-term rents (£475 + £875 pcm) and high-yield holiday let income (~£18k/year) provides both security and enhanced returns. This mitigates risk and allows flexibility in strategy (you could convert the Airbnb to a standard tenancy if preferred, or continue maximizing short-let profits).

Additional Potential: The property features a large cellar, currently used for storage, which could offer added value. There may be potential (subject to planning and conservation approvals) to convert or better utilize this space in future – or simply use it for tenants’ storage to make the flats more appealing. The upper floor Airbnb’s strong performance suggests an opportunity to further capitalize on Manningtree’s tourism by possibly increasing occupancy or slightly adjusting rates, thereby boosting overall yield even more.

In summary, this property presents an exceptional investment opportunity: a fully-tenanted, characterful building in a thriving small town location, with a healthy rental yield and room for growth. It is well-suited to investors seeking a blend of reliable income and capital preservation in a tangible asset with historic charm.

EPC Rating: E

Key Features

- Full freehold investment incorporating three flats. Two on assured shorthold tenancies and the other an Air bNb

- Three self-contained units (2 long-term lets + 1 high-performing Airbnb) generating a combined £34,200 annual income

- Strong 6.84% Gross Yield - Excellent return for a freehold asset in the South East — ideal for investors seeking cashflow and long-term value.

- Historic Town Centre Location - Situated on picturesque South Street, just steps from shops, cafés, the riverside, and Manningtree’s charming high street.

- Walking distance to Manningtree station with direct trains to London Liverpool Street in under 1 hour.

- Tourism Hotspot & AONB Proximity - Positioned on the edge of Dedham Vale Area of Outstanding Natural Beauty — high appeal for guests and tenants alike.

Property Details

- Property type: Block Of Apartments

- Price Per Sq Foot: £205

- Approx Sq Feet: 2,435 sqft

- Plot Sq Feet: 1,184 sqft

- Property Age Bracket: Pre-Georgian (pre 1710)

- Council Tax Band: B

Rooms

Communal entrance

Access to flat one, the cellar and to outside.

First floor landing

Access to flat two. Up to flat three.

Flat two bedroom two

3.73m x 4.14m

Second floor landing

Access to flat three.

Flat three bedroom two

2.31m x 2.20m

Cellar room one

2.75m x 4.28m

Cellar room two

5.03m x 5.58m

Floorplans

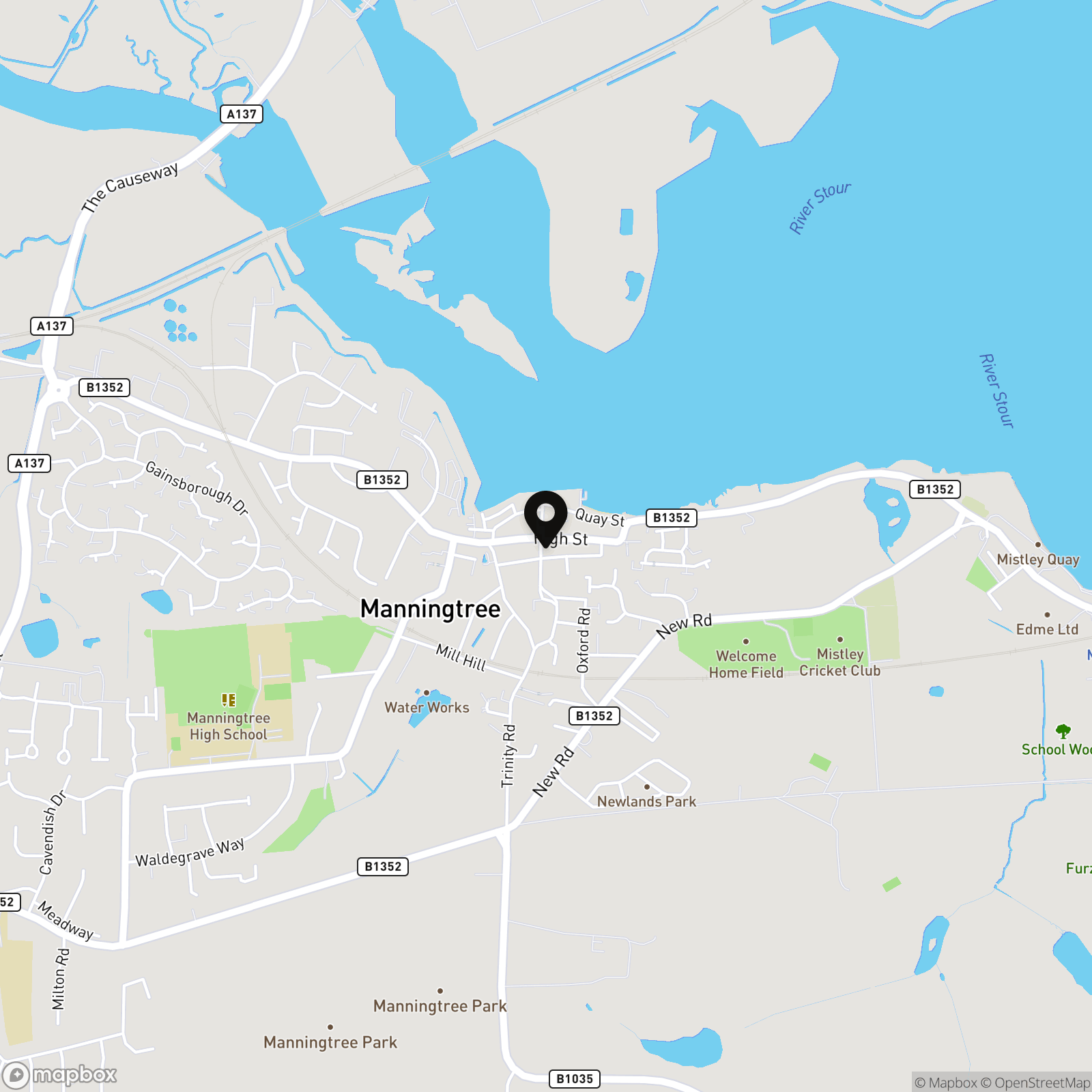

Location

Properties you may like

By Churchwood Stanley