HMRC is cracking down on compliance, is your agency prepared?

As of last year, compliance has become more important than ever for estate agents. In August 2022, HMRC published a list of firms that received penalty notices after failing to meet their anti-money laundering (AML) obligations - nearly 50% of them were from the property industry.

While there seem to be failings when it comes to estate agency compliance, it is mostly accidental. Maintaining an understanding of the ever-changing rules, carving time out to dedicate to AML and finding someone who is free to do it are all extremely difficult factors for agents, particularly those still relying on manual checks.

Regardless of whether these failings are accidental or not, HMRC maintains that compliance checks will be regulated even further with the intention of clamping down with harsh fines or even prosecution on anyone who fails to comply. Agents are urged to take their compliance checks more seriously and with even greater caution or risk facing the consequences.

Money laundering attempts are on the rise.

It isn’t just HMRC checks that are increasing, attempts of money laundering through property have been on the rise since 2021…

In 2021, the National Crime Agency’s (NCA) Annual Report highlighted the increasing use of the property sector for money laundering. The report explained that criminals use high-value property transactions to launder illicit funds, with the UK market being a specific place of interest thanks to its high value and perceived stability.

In fact, the property market is one of the UK’s most vulnerable sectors because offshore companies can buy UK property, allowing the ultimate beneficial owner (UBO) to stay anonymous.

Now more than ever, it’s essential for agents to understand the laws and compliance surrounding AML. To add to the compliance crackdown, HMRC has released further details on the regulations agents must adhere to; those who don’t risk being fined.

Though, as we’ve already realised, complying with HMRC’s regulations can be prone to long transaction times, missed checks or worse still, mistakes.

As property is perceived as a gateway to money laundering, it’s vital that all agents are clued up on the latest legislation and know how to enforce it should they be suspicious of a buyer or seller.

What’s the guidance?

The current guidance set out by HMRC stands at around five key points, centred around the following:

1. Pass approval checks and register

Above anything, agents must register with HMRC. However, before they can do this, senior managers or agency owners must complete and pass approval checks.

2. Create a policy statement

Agencies must draft a policy statement that outlines who is responsible for managing the exposure to the risk of money laundering and the following procedures.

3. Clue up your staff on the guidance

Owners or managers must ensure all team members are aware of the current compliance guidelines and give them the relevant training on identifying suspicious activity.

4. Check who your clients really are.

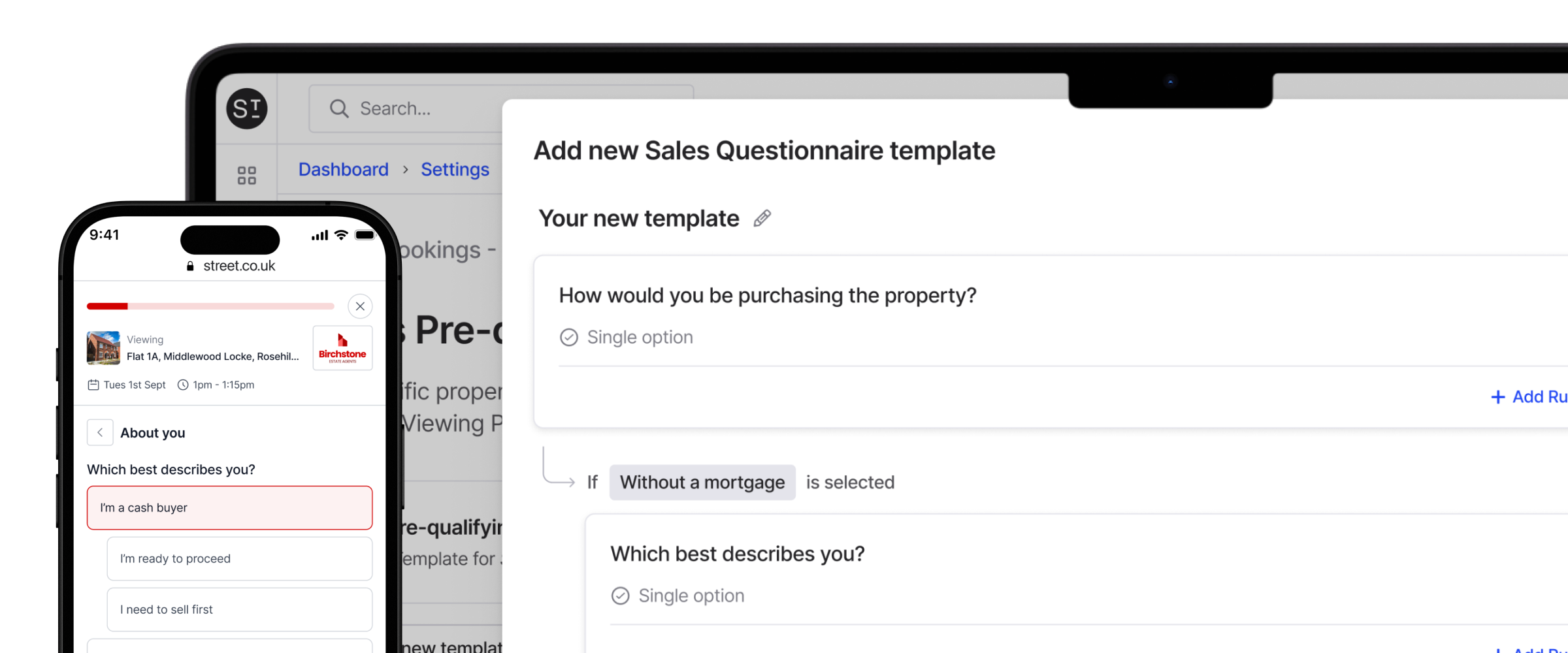

HMRC states that, before progressing a transaction with anyone, agents must take the necessary precautions to ensure clients are who they say they are.

5. Keep a note of everything

While it may seem obvious, agents are required to keep everything on record, including things like contracts, proof of sale, and more.

Why manual checks could risk your reputation.

Stricter clampdowns on compliance are on the rise, and it means that agents have to be more cautious than ever before. In fact, Estate Agent Today recently warned of the risk of carrying out anti-money laundering checks manually, suggesting that those who do could be putting themselves at risk of tarnishing their reputation and finances.

The article stated that only around 33% of agents said they could confidently identify a fake document. This coupled with slow processing of documentation, and the rise in money laundering, only further highlights the issues with manual AML checks.

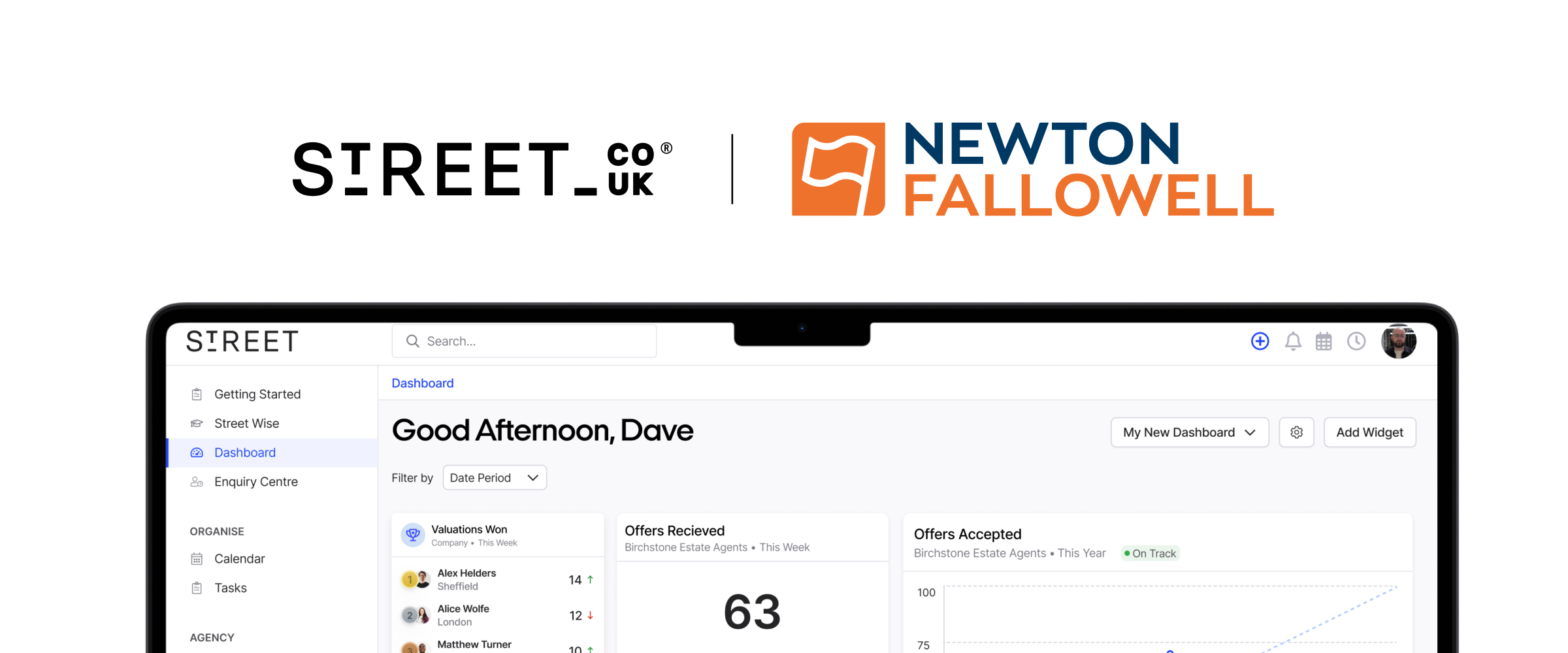

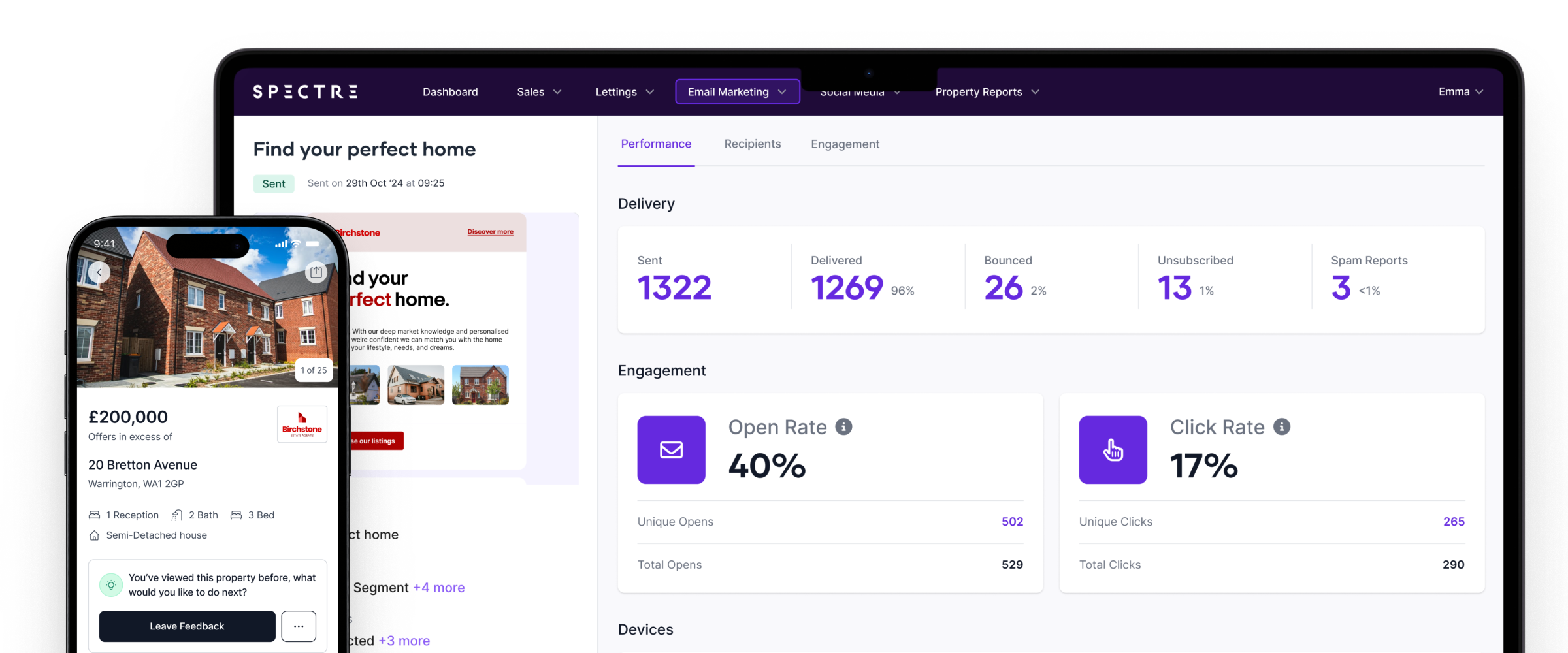

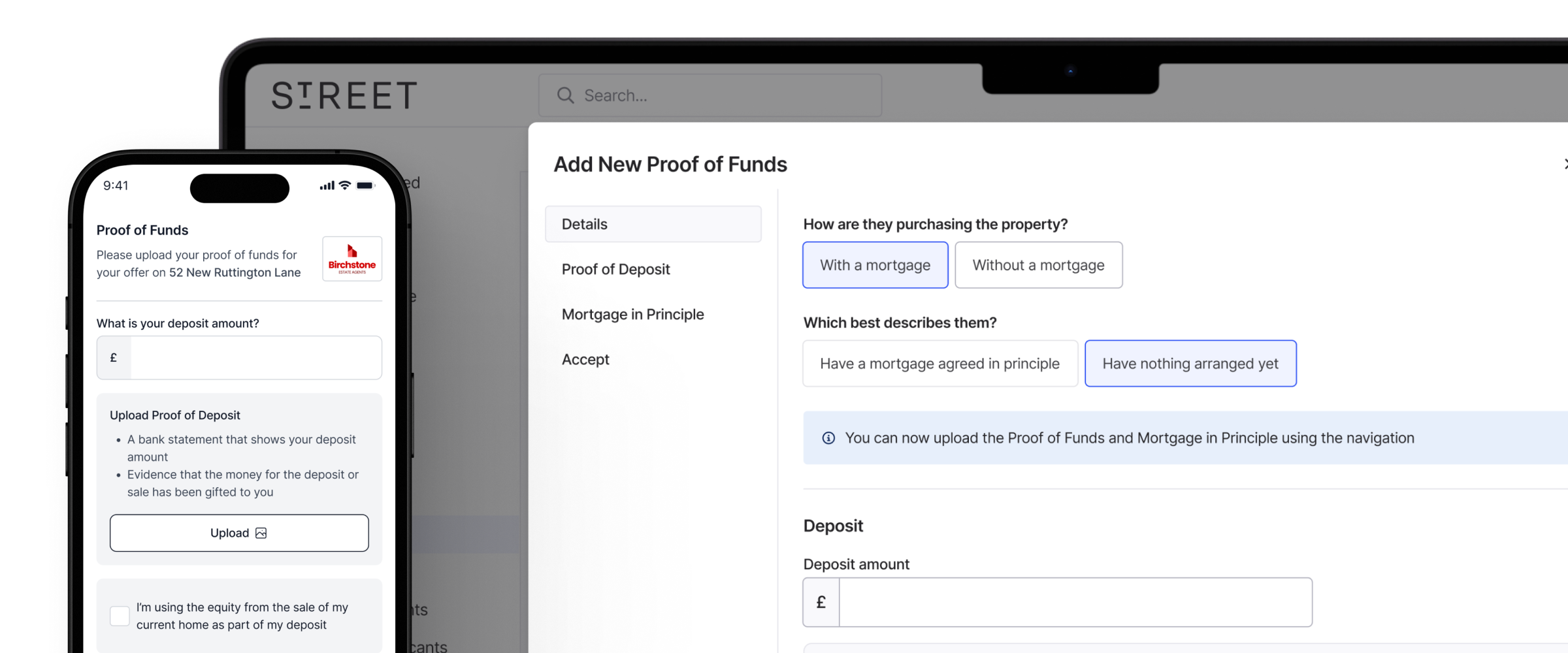

By choosing to automate AML checks, agents have an additional layer of security and completely remove the risk of slow transaction times or missing checks - with the added guarantee that no mistakes will be made. Thanks to our new Landmark-powered integration, agents using Street.co.uk can easily navigate through applicant and vendor checks in just a few clicks of a button. With Street.co.uk’s integrated AML checks, agents will get:

Complete peace of mind

With Street.co.uk’s Landmark integration, AML checks will be automated and handled for you, giving you peace of mind while ensuring compliance is completely adhered to.

Quicker transaction times

By outsourcing AML compliance tasks, you’ll benefit from fast, thorough checks and speed up your transaction times.

No more missed checks

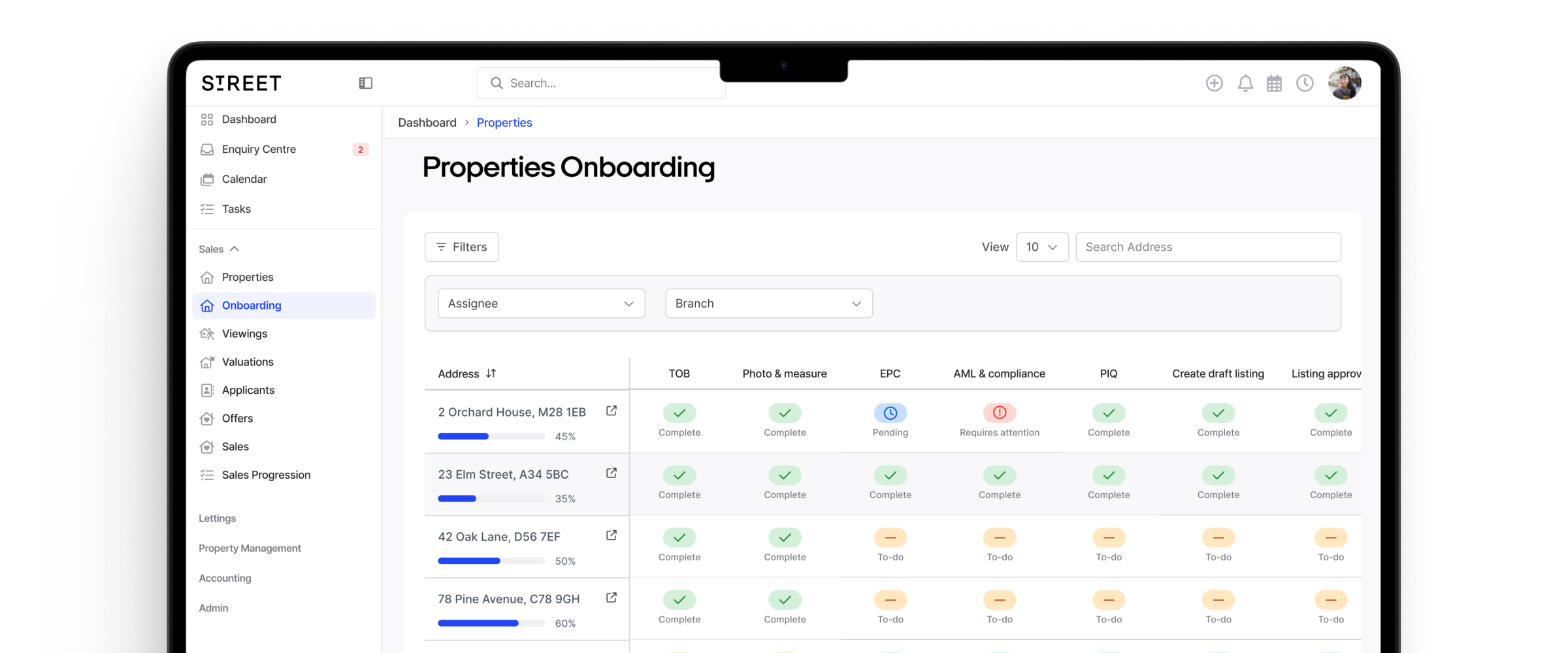

Stay on top of important AML compliance with a clear breakdown of the applicant and vendor checks that are required.

Live status updates

As soon as a check is completed, its status is instantly updated in Street.co.uk with passed or failed, so everyone is kept in the loop.

All of our agents can start using this feature by asking out Support Team to switch it on in their account. If you’re not a current client, you can find out more about Street.co.uk's AML checks booking a demo.

.png)

.png)

.jpg)

.jpg)

.png)

.png)

.png)

.jpg)

%20(1).png)

.jpeg)

.png)

.jpeg)

.jpeg)

.jpg)

.jpg)

.png)

.jpg)